Use Case

Third-Party Due Diligence Solutions

Now there’s a better approach to third-party due diligence. Automate risk screening, management, and monitoring, so you can stop risks before they stop you.

Trusted by leading global companies

What is third-party due diligence?

Any individual or entity involved in your supply chain or conducting business on your organization’s behalf, such as suppliers, distributors, agents, or partners, can potentially expose your business to unforeseen risks. These risks span a wide range of areas, including compliance, ESG (Environmental, Social, and Governance), ABAC (Anti-Bribery and Anti-Corruption), reputational, operational, financial, cybersecurity, and more.

Third-party due diligence is a critical component of any effective third-party risk management program. It involves assessing your third parties during both the onboarding process and on an ongoing basis to identify, understand, and manage these potential risks.

A well-designed compliance program is expected to apply risk-based due diligence to its third-party relationships.

The challenge of third-party due diligence management

In today’s interconnected global marketplace, third-party relationships are essential for business growth and operational efficiency. However, these relationships also pose significant compliance challenges. With hundreds, if not thousands, of third parties to manage, and an ever-increasing list of interconnected risks to assess and monitor, compliance teams are facing an unfair fight.

Too often, compliance teams must navigate between multiple outputs from different screening providers, relying on poorly formatted data that isn't aggregated - and worse still - creates the additional noise of hundreds of false positives. This approach only makes your job harder, not easier. You deserve better.

GAN Integrity for better third-party due diligence

Fortunately, with the right resources, technology, and support, you can manage third-party due diligence more effectively. That’s why leading organizations around the world rely on GAN Integrity. We help you:

See everything

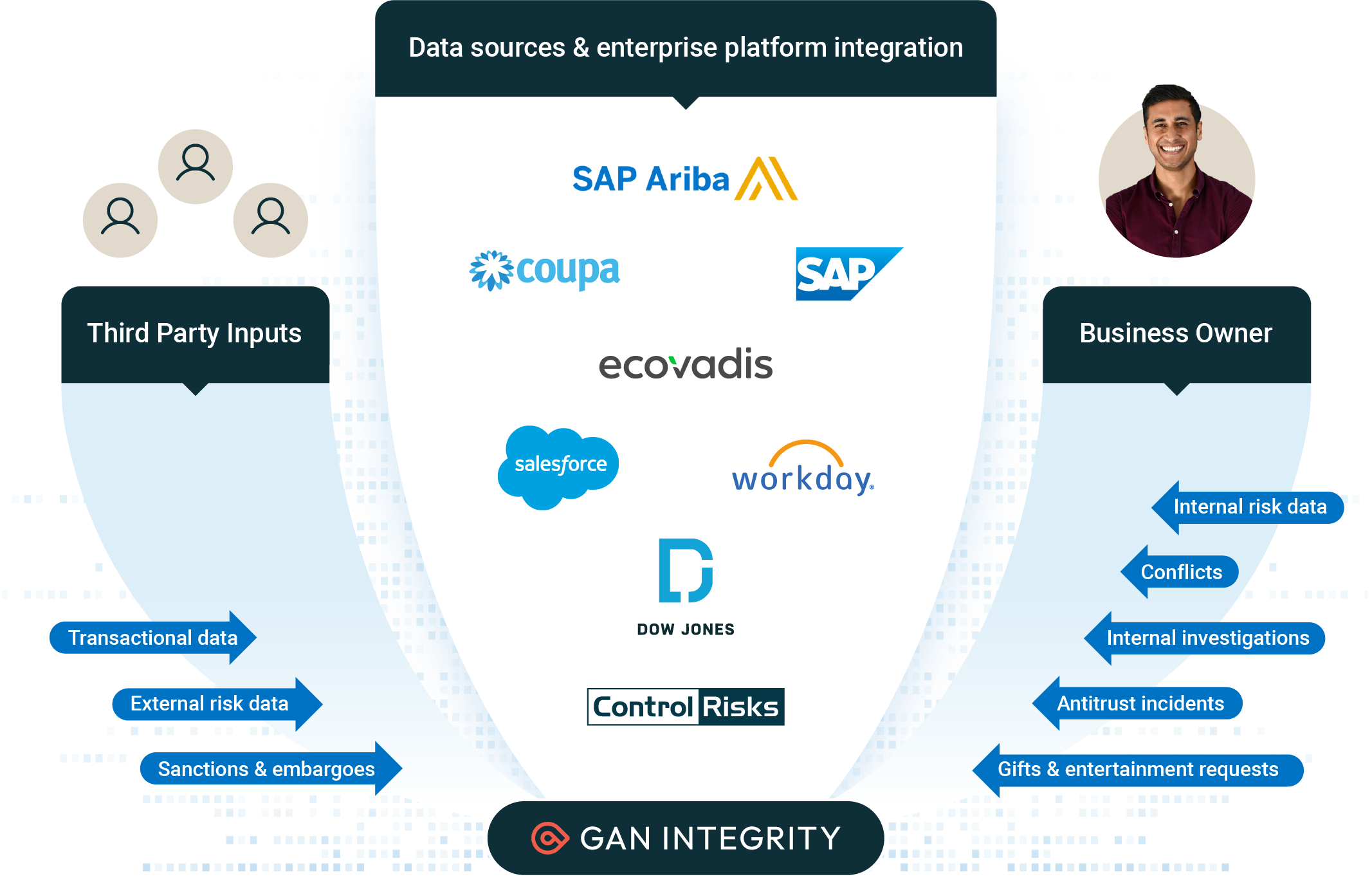

GAN Integrity provides a comprehensive view of your third-party relationships:- Centralized data integration: Data from multiple risk intelligence and business system sources, is consolidated in a single system, offering a single, unified view of all third-party risks.

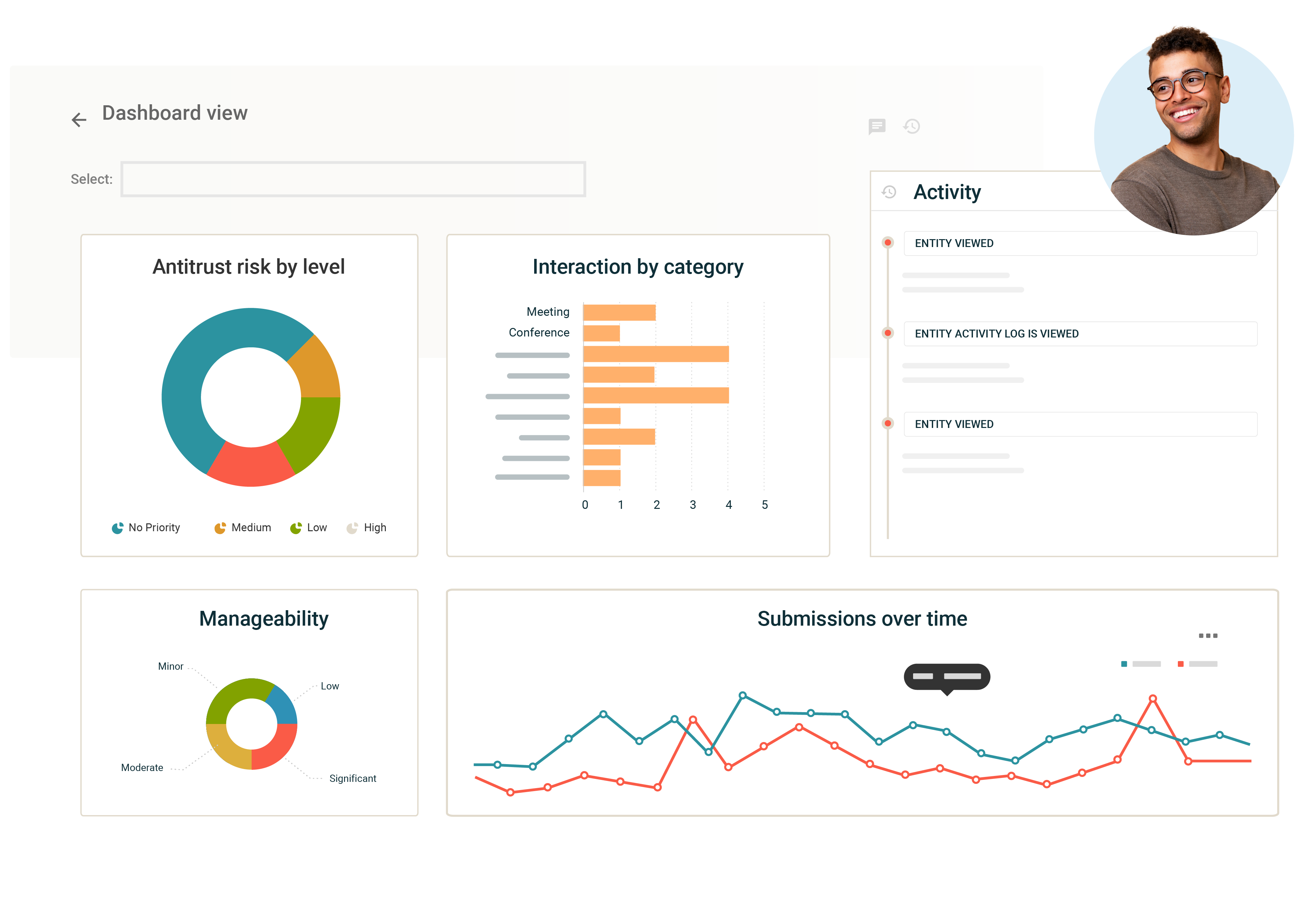

- Advanced analytics: Powerful analytics tools provide real-time insights into potential risks, enabling you to make informed, risk-based decisions.

- Real-time monitoring: Stay updated with real-time monitoring, ensuring you are always aware of and can act on changes in risk profiles.

Adapt to anything

In a constantly changing regulatory landscape, GAN Integrity ensures your compliance program is agile and resilient, without the need for expensive IT projects:

- Dynamic risk assessment: Continuously assess and reassess risks as new information becomes available and add new risk domains with ease. This proactive approach ensures you stay ahead of potential compliance issues, and are always ready for what’s next.

- Customizable workflows: Tailor workflows to fit your specific compliance needs, ensuring that your due diligence processes are efficient and effective.

- Scalable solutions: Whether you're just starting out and transitioning from spreadsheets, or you need a highly customized enterprise-scale program, our scalable solutions grow with you, adapting to your changing requirements, without heavy lifting or expensive IT projects.

Get all the Help you Need

GAN Integrity offers comprehensive support and resources to ensure your success:

- Expert support: Access our team of compliance experts for guidance and support, from helping you navigate the best risk intelligence sources to supporting continuous improvements in your solution.

- Best practice embedded: Benefit from extensive best practice data sources, workflows and reporting already assembled in your solution, but with the flexibility to adjust and modify.

- Influence development: Be a part of a community of clients whose inputs are listened to and developed for the good of the entire compliance community.

Our Products And Solutions

ABAC Program Management

Ensure your organization upholds ethical integrity and ABAC compliance through comprehensive risk assessments, effective policy management, and continuous monitoring. Capabilities include:

- Third-party due diligence: Mitigate bribery and corruption risks with integrated questionnaires, sanctions checks, and risk intelligence data.

- Disclosure management: Consolidate and assess conflicts of interest (COI), gifts, travel, entertainment, and political and charitable contribution disclosures.

- Reporting and documentation: Maintain a complete audit trail and detailed reporting to easily demonstrate compliance to stakeholders and regulators.

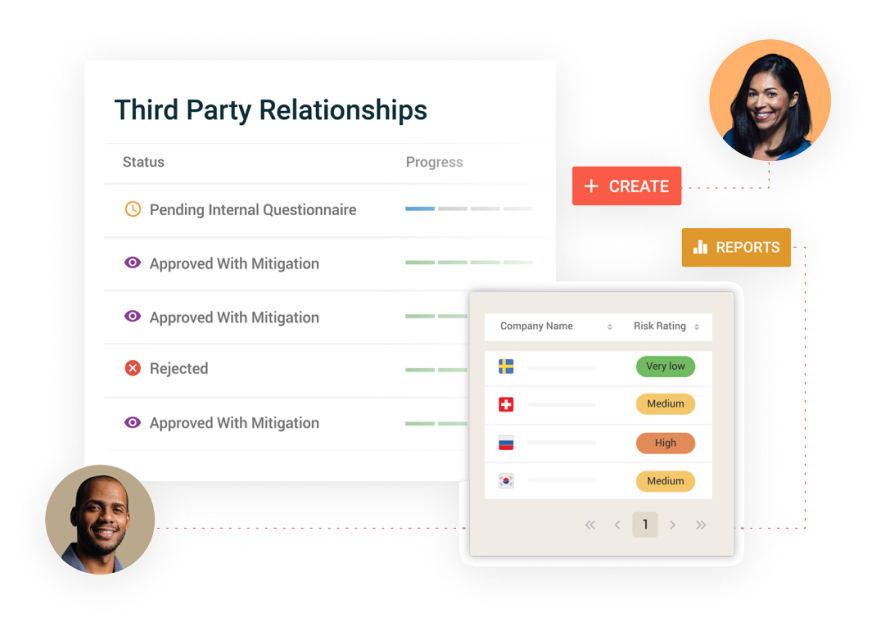

Third-Party Risk Management

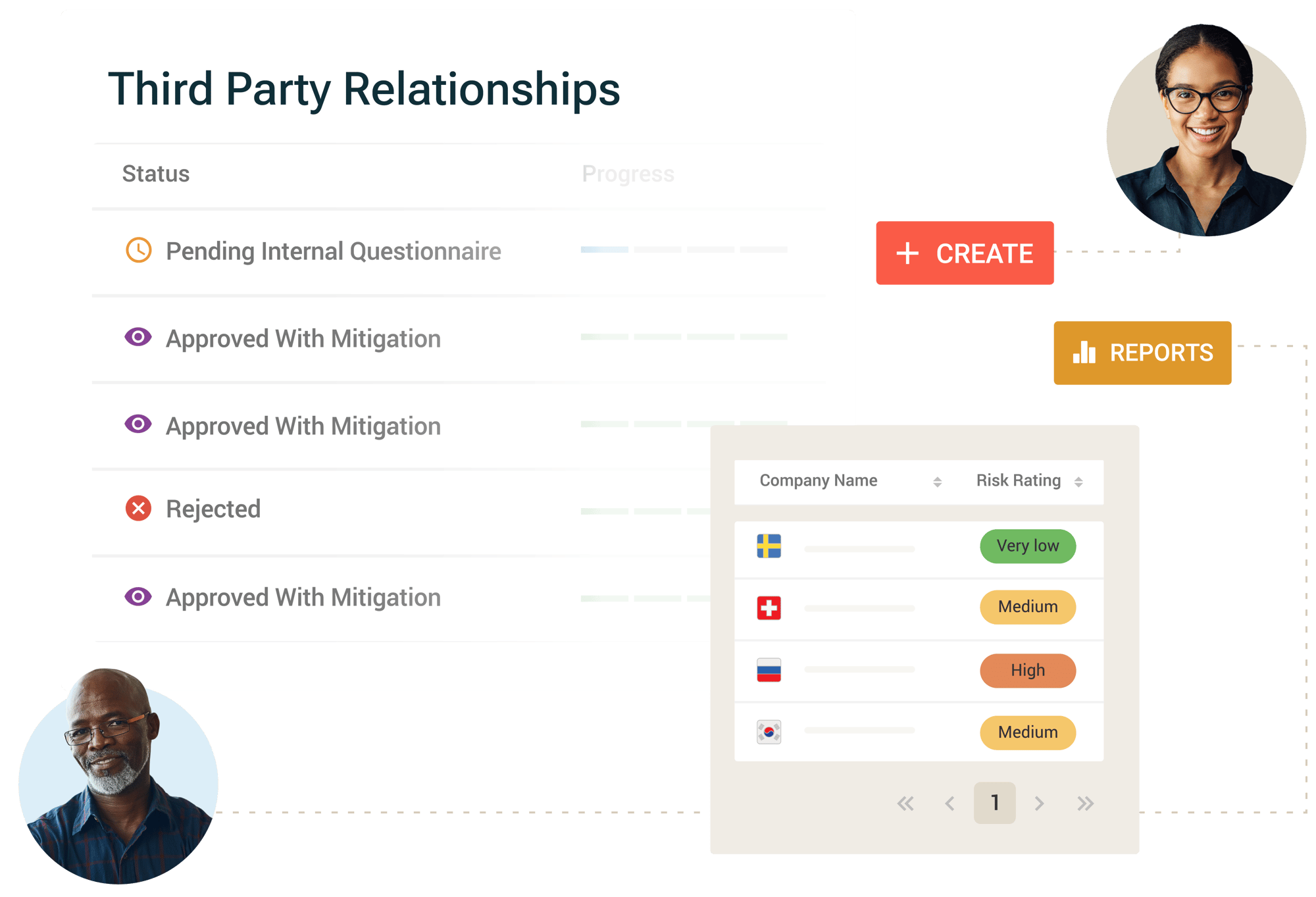

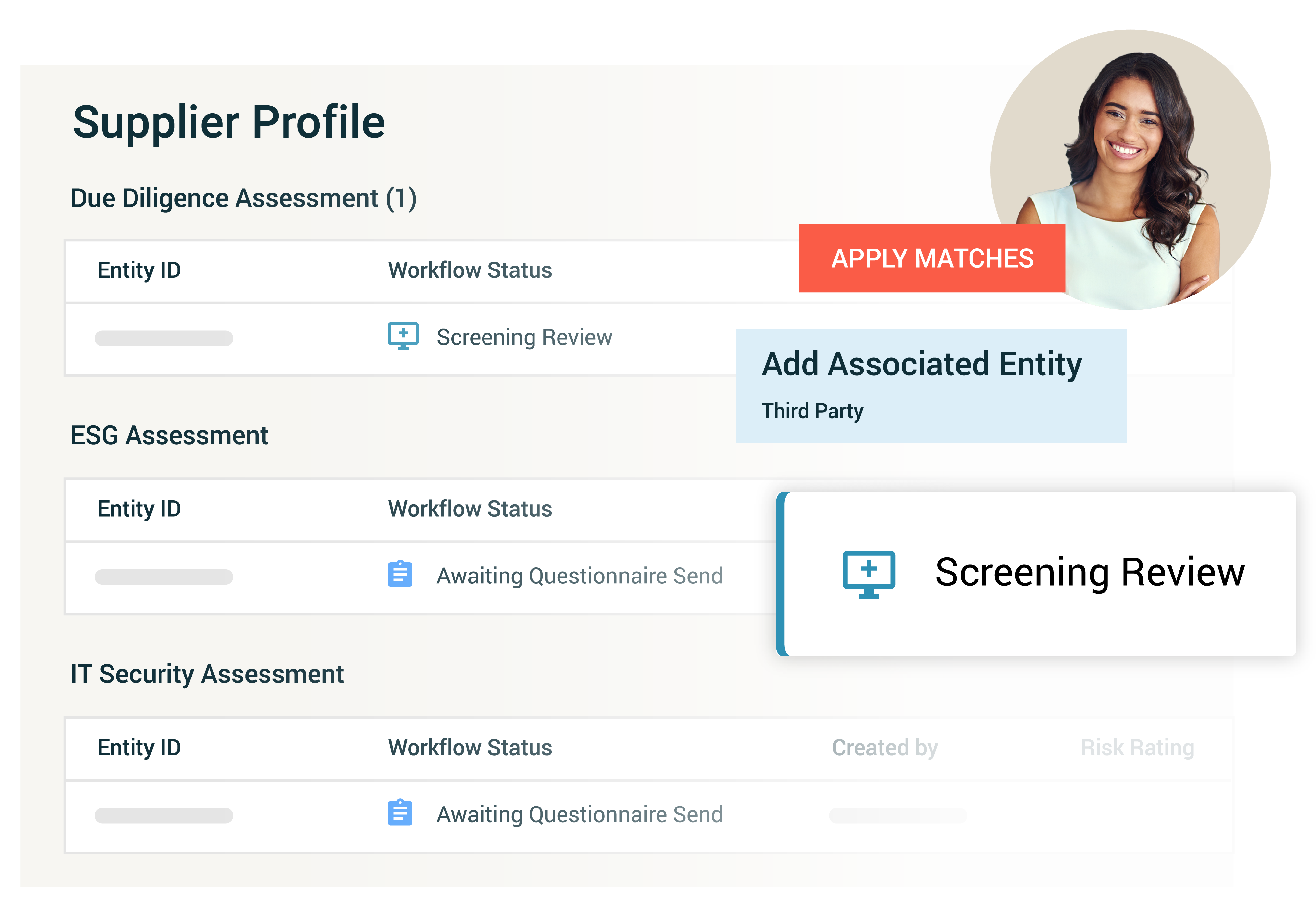

Manage risks associated with third parties and assess these against relevant laws and organizational standards. Capabilities include:

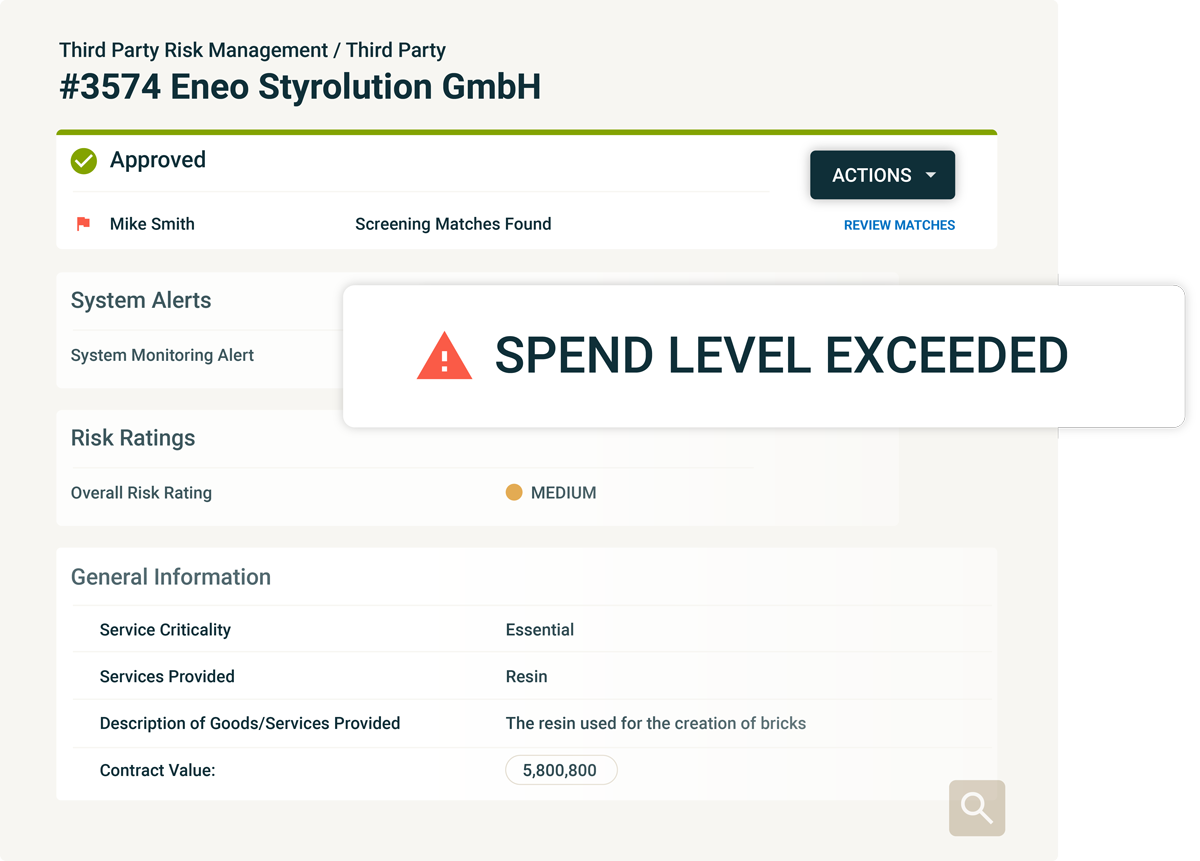

- Lifecycle management: Automated workflows for onboarding, risk assessment, issue management, monitoring and off-boarding.

- Integrated due diligence: Initial and ongoing screening of third parties for sanctions, adverse media, forced labor, ESG and more.

- Reporting and analytics: Executive dashboards and reports: Consolidate third party data to identify risks and potential exposure to your organization.

Supply Chain Due Diligence

Enhance supply chain risk management by consolidating processes, identifying and mitigating risks, and integrating data from various risk intelligence and business systems. Capabilities include:

- Automated risk assessments and continuous monitoring: Monitor suppliers continuously for adverse media, sanctions lists, PEP lists, forced labor, and ESG (Environmental, Social, and Governance) issues.

- High-risk supplier identification and management: Identify high-risk suppliers, manage them effectively, and track actions and mitigations to ensure compliance.

- Integrated due diligence assessments: Perform thorough due diligence across your business operations and workflows for seamless integration and enhanced efficiency.

Disclosure Management

Consolidate your disclosures for conflicts of interest (COI), gifts, travel, entertainment, and political and charitable donations or contributions. Capabilities include:

- Policy management: Develop and enforce comprehensive disclosure policies. Educate and engage your workforce with targeted training and policy attestations.

- Flexible disclosure process: Simplify the submission of potential conflicts of interest with user-friendly forms, ensuring easy access for employees.

- Automated approvals and reviews: Enhance compliance with automated approval and review workflows. Quickly escalate notifications to relevant stakeholders to address potential risks.

Reporting and Documentation

See everything across your compliance program, and generate reports and dashboards to demonstrate compliance program effectiveness to stakeholders and evidence to regulators. Capabilities include:

- Reporting and analytics: Executive, role-based dashboards to review the effectiveness of your compliance program initiatives.

- Evidence-based compliance: Maintain an auditable trail of all activity with the platform’s integrated and automated audit log.

- Compliance insights: See risk trends and patterns within your program, including third-party and supply chain risk, policies and disclosures.