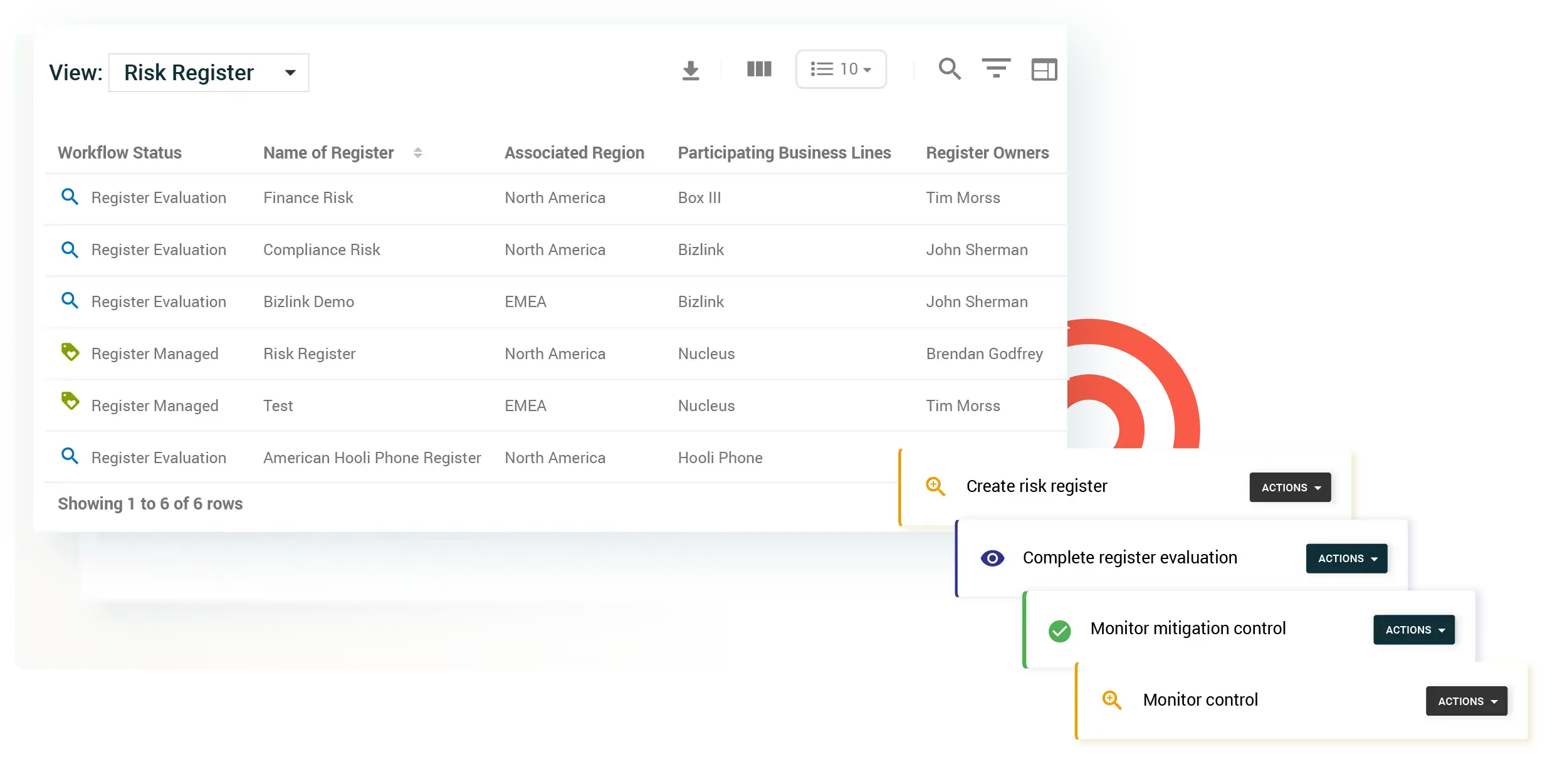

Risk Assessment Software Solutions

Implement a thorough risk assessment program capable of identifying and categorizing all risk.

Stakeholder engagement

Visualize risk and launch remediation in one place.

Through custom integrations with the Integrity Platform, view risk data holistically and grant risk owners the tools they require to support a global risk management program at scale.

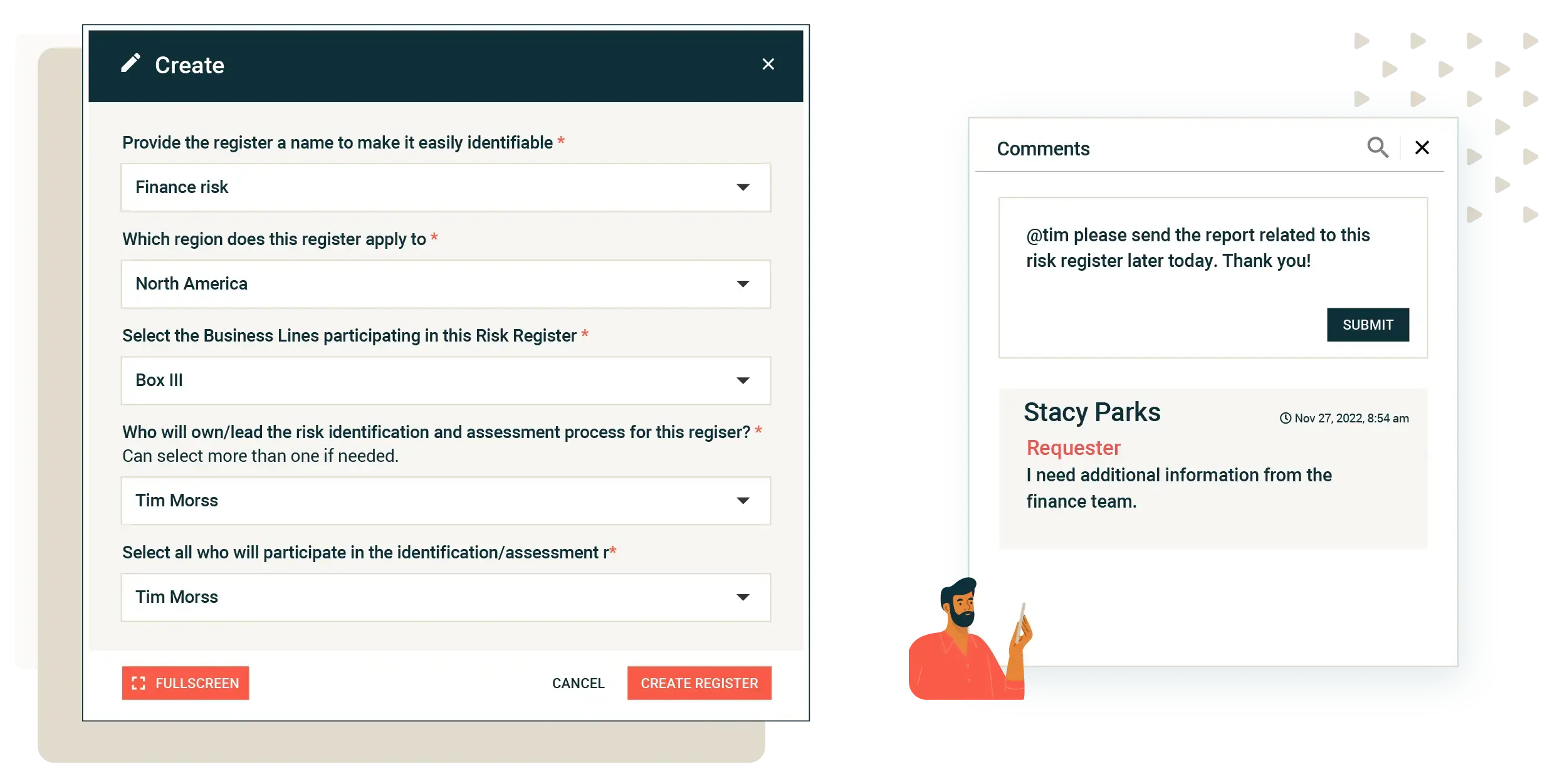

Accessibility

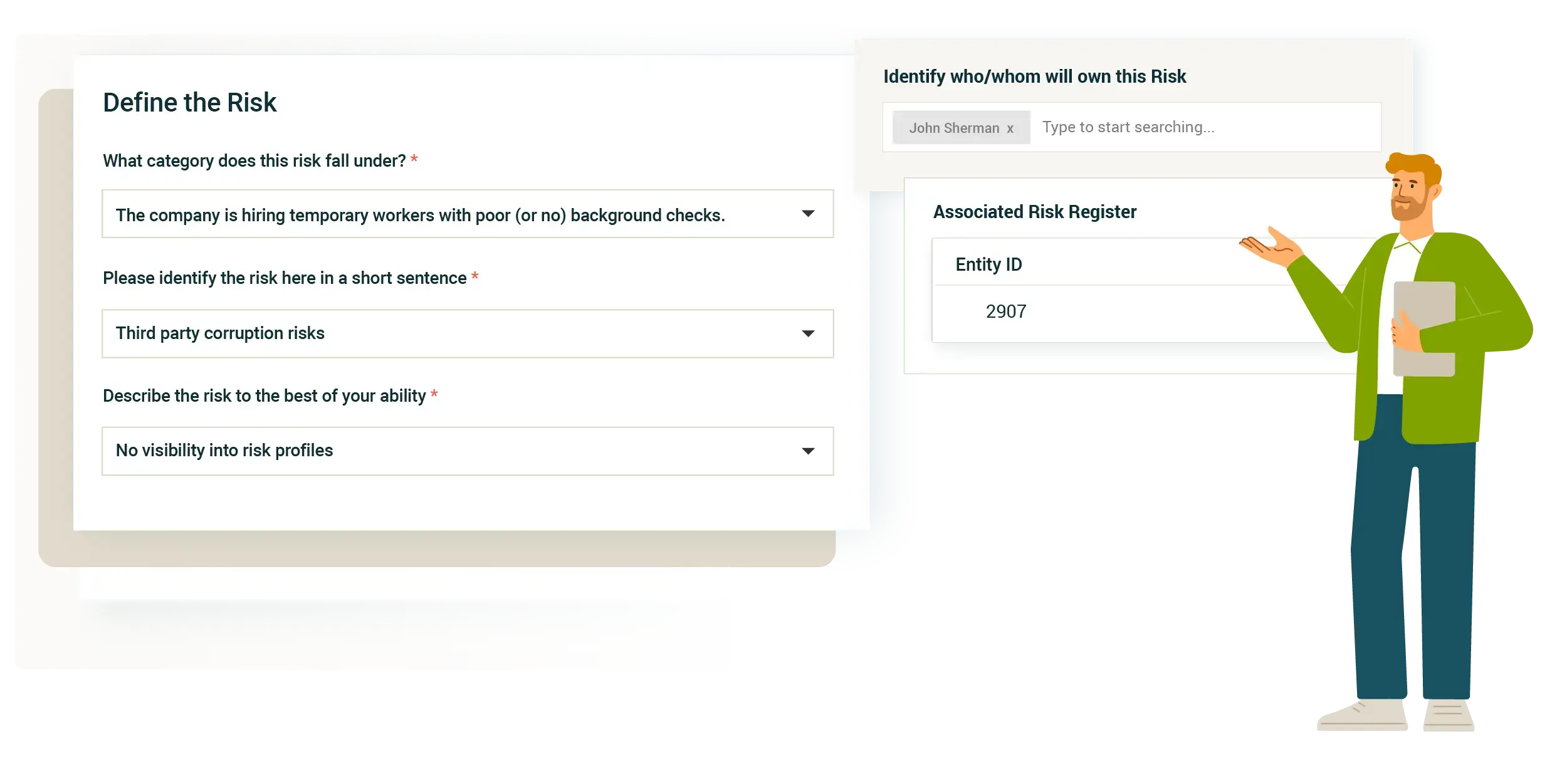

Enable all stakeholders to flag risk

Create an environment where risk owners are empowered to flag risks from anywhere at any time with an intuitive and customized user journey.

Localize assessments

Facilitate communication and collaboration in languages native to users with granular localization.

Customize inputs

Tailor assessment forms to the specificities of each business unit for swift remediation.

Accommodate users

Guarantee everyone can relay risk information quickly with embedded communication capabilities.

Productivity

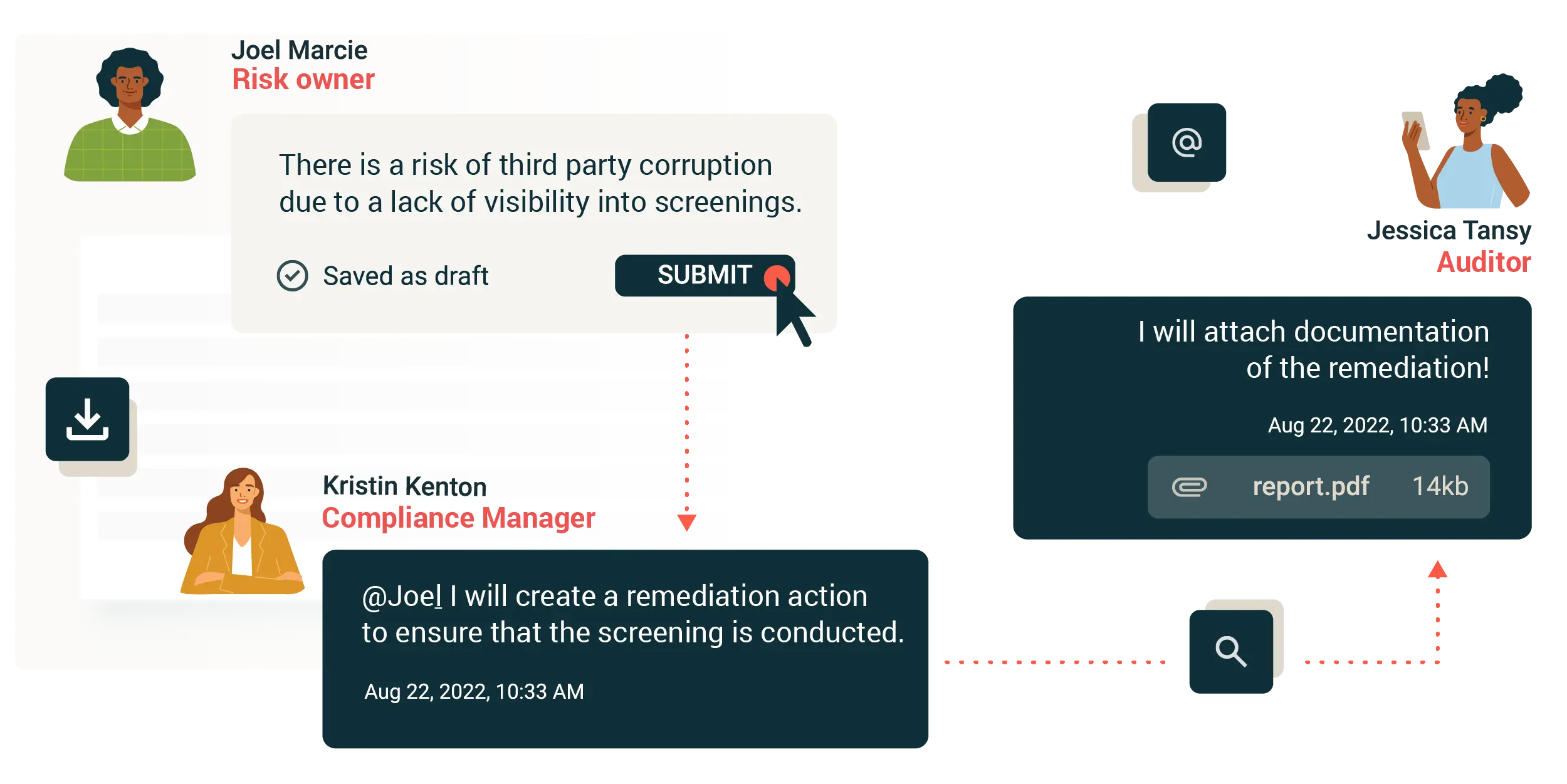

Decentralize accountability for compliance

Ensure members of the organization become active participants in the risk management process regardless of function or location.

Instant translation

Communicate easily through built-in chat functionalities and leverage integrated localization features for instant translation.

Risk ownership

Allow stakeholders to employ risk-averse strategies using their knowledge of risks related to their region and operations.

Engage stakeholders

Collect information throughout the business by providing stakeholders with tailored risk assessment questionnaires.

Integration

Address risk in context

Transform aggregated data into compliance intelligence insights. Integrate processes and embed ethics for a holistic view of considerations and decisions.

Connect risk data

Build bridges between data sources to resolve risk in a fully informed context, combining business-wide data and external risk intelligence.

Embed controls

Embed risk mitigations into all operations by connecting your program to other core operations platforms used around the business.

Empower risk owners

Extend compliance ideals into other functions by enabling employees to flag risky activity through integrated escalation routes.

The Integrity Platform ensures businesses can manage risk scalably and during times of change with powerful integrations, customized access control, and scalable process management.

Scalable design

Completion of a comprehensive questionnaire addressing the business qualifications, financial solvency, and legal and regulatory history of the proposed business partner.

Adaptable structure

Complex enterprise pivots are reflected in your risk management program, capturing new risk indicators and connecting them to existing data to package meaningful insights for effective remediation.

Reporting

Gain a competitive edge

Identify patterns and uncover hidden risks with fully encompassing dashboards that give you meaningful insights to protect your business.

Aggregate data

Allow data flow back to a centralized view to get the full picture of your company’s risk exposure.

Holistic risk views

Collect data related to specific cases, requests, third parties, or other entities across the platform.

Ad-hoc reporting

Create custom dashboards and allow teams to get quick and meaningful interpretations of the data.

When you can integrate the data you are tracking — that’s where I truly see the future of analytics, tracking, and measurement for ethics and compliance.

Deborah Spanic

Chief Ethics & Compliance Officer at Clarios