In the world of third-party risk management (TPRM), technology has advanced rapidly. Platforms are now customizable, intuitive, and automated. But here's the catch: no matter how sophisticated the system, if the data it processes is flawed or incomplete, the outcomes will inevitably be compromised. Compliance teams are often left wading through inaccurate or outdated data, a reality that not only frustrates but bogs down their ability to effectively mitigate risks.

As organizations demand deeper insights into their supply chains and third-party relationships, data quality becomes paramount. A single "bad apple" in the supply chain can trigger legal, financial, and reputational risks. In fact, 86% of businesses believe poor data quality is a significant obstacle to effective compliance reporting, and 59% say it’s a major issue (PwC). This surge in data volume and complexity means that companies need more than just advanced technology—they need accurate, reliable, and relevant data to drive their TPRM programs.

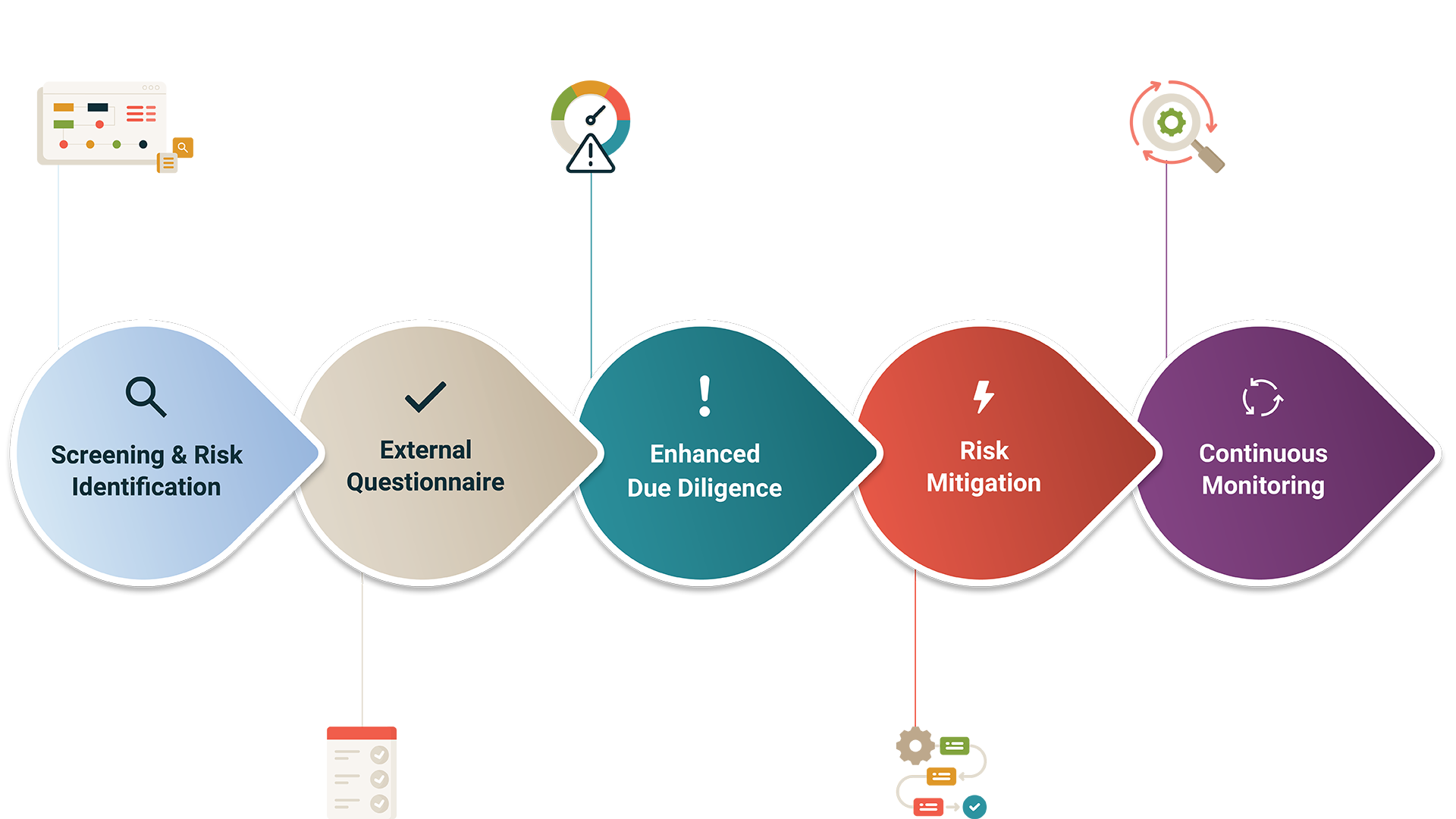

The Importance of Reliable Data in Key Stages of TPRM

The risk-information-gathering phase is the bedrock of the TPRM process. If the data collected is flawed or insufficient, compliance teams often have to rely on self-disclosed questionnaires, expensive analyst-driven due diligence reports, and manual checks—each of which is costly and time-consuming. These stages form the foundation of the entire process, and poor data quality at the outset can compromise the rest of the assessment. The initial phase, where information on third-party entities is gathered, is particularly vital. This is where external risk intelligence solutions play a pivotal role in providing accurate data for compliance teams to act upon.

At the initial stages of a due diligence process, there are three primary categories of data used to gather risk-related information:

-

Sanctions & Watchlist Data: structured data primarily sourced from government and open-source sanctions and watchlists.

-

Risk Intelligence Databases: These databases offer structured profiles of entities that consolidate sanctions, politically exposed persons (PEPs), limited adverse media, and in some cases, state-owned enterprises (SOEs).

-

Adverse Media Data: unstructured data with a focus on risk events found in news and web content.

How Legacy Risk Intelligence Falls Short

The current landscape of risk intelligence largely stems from tools originally developed for KYC (Know Your Customer) or AML (Anti-Money Laundering) compliance. These systems, while widespread, fall short when used for corporate due diligence. Some key limitations include:

-

Limited risk coverage: Outdated technology and manual data-gathering limit coverage, leading to gaps in risk information.

-

Overwhelming false positives: Due to an inability to consolidate and synthesize the flow of information coming from unstructured web data and limited fuzzy matching capabilities, compliance teams are often flooded with hundreds of false positives, especially for larger companies. Compliance teams waste valuable time clearing these while smaller companies—potentially more risky—get lost in the shuffle.

-

Escalating costs: With insufficient data returned from initial screenings, compliance teams must resort to costly, human-led due diligence reports, which are not scalable for assessing multiple third parties.

-

Lack of integration: Data often arrives in unstructured formats, such as PDFs, making it impossible to integrate across platforms or leverage automation to streamline processes. Compliance teams are forced to manually review each report, increasing the risk of human error.

-

Slow decision-making: The slow turnaround of manual reports and the endless review of data slow down the decision-making process, delaying critical business operations.

-

Frustrated stakeholders: The reliance on lengthy questionnaires and self-verified information can frustrate third parties and fail to provide the independently verifiable insights compliance teams need.

This outdated approach is simply no longer viable. Compliance teams need a solution that works at the speed and complexity of today’s global business environment.

AI-Driven Solutions: A New Era for TPRM

It has been nearly 25 years since the first Risk Intelligence Databases emerged, aimed at helping financial institutions and corporations identify customer and third-party risks. Since then, the explosion of the internet and access to information has created a diverse risk data landscape. Today, AI-driven tools are transforming the way compliance teams operate by making risk intelligence more efficient, accurate, and actionable.

AI technology enables compliance teams to analyze and act on vast amounts of data with unprecedented speed and accuracy. These modern tools combine powerful data processing with responsible AI, transforming TPRM in key areas:

-

Risk-relevant information: Rather than drowning in data dumps, compliance teams receive summarized, actionable insights that focus on what matters most.

-

AI-driven disambiguation: Advanced algorithms minimize false positives, helping compliance teams make faster decisions while reducing the manual labor involved in sorting irrelevant data.

-

Broad risk coverage: AI ensures no stone is left unturned, providing a comprehensive overview of risk with frequent, broad-ranging data collection. Reports on even small companies are returned - all in real-time allowing teams to take immediate action.

-

Structured, connected data: Data is presented in structured formats that can be easily analyzed and integrated into broader systems, offering a holistic view of third-party risks.

The outdated way of managing third-party risks—relying on flawed data and manual processes—is no longer sustainable in today’s fast-paced environment. AI-powered solutions are transforming third-party risk intelligence by providing faster, more accurate, and cost-effective tools.

While AI offers undeniable advantages, skepticism remains. Concerns about data privacy, transparency, and ethical use are valid and must be addressed. However, AI solutions designed specifically for compliance are built with these concerns in mind. Rather than replacing human judgment, AI enhances it by reducing the manual burden and providing clearer, more accurate data. By adopting AI responsibly, compliance teams can make more informed decisions while maintaining the integrity of their risk management processes. As compliance requirements become more complex, it’s essential for organizations to embrace these advancements. By doing so, they can not only enhance their risk management programs but also ensure they remain agile and resilient in the face of evolving challenges. The future of third-party risk management is here—and it’s powered by AI.

See it for yourself. With Integrity Identify™ third-party risk identification has never been more accurate or faster.

Miriam Konradsen Ayed is the VP of Product Marketing at GAN Integrity. With a track record of building and executing GTM strategies and growing pipeline for SaaS products, she brings products to life through value-driven positioning and messaging.