Regulations

Compliance Solutions for SAPIN II

Benefit from a centralized, risk-based approach to compliance for the French legislation SAPIN II. Gain a thorough understanding of your overall anti-bribery and corruption risk posture and operate with the confidence that you have robust and effective procedures in place.

Why GAN Integrity

GAN Integrity is how compliance teams get the tools and expertise to stay ahead of ABAC risk. With less effort but more reach, you finally get a better way to do your good work.

See everything – Gain a comprehensive view of your anti-bribery and corruption risks in one centralized platform.

Adapt to anything – Utilize a dynamic solution that adapts to regulatory changes and evolves with your program.

Get all the help you need – Receive dedicated support from GAN Integrity’s team of experts.

Understanding Sapin II

French legislation, Sapin II, came into effect in June 2017, requiring companies operating in France, including foreign subsidiaries, to implement effective anti-corruption programs. These programs are designed to prevent and detect bribery and undue influence, adhering to the rigorous standards set by the French Anti-Corruption Agency (AFA).

Inspired by the US FCPA and the UK Bribery Act, Sapin II mandates strict regulations, including increased organizational transparency, stronger internal monitoring systems, robust whistleblower protections, and effective supply chain risk management due diligence. The French Sapin II law targets corruption by requiring certain companies to implement anti-corruption programs. It applies to:

Large French companies: Those with at least 500 employees and a turnover exceeding €100 million.

French subsidiaries of large groups: Even if the subsidiary has fewer than 500 employees, it must comply if the parent company in France meets the employee threshold and the group's consolidated turnover exceeds €100 million.

The Importance of Compliance With SAPIN II

Non-compliance with Sapin II can lead to severe penalties for both companies and individuals. Companies can be fined up to €1 million for failing to implement required compliance programs, and up to €5 million or double the benefit derived from corruption in actual corruption cases. Additional sanctions may include judicial supervision, bans from public contracts, and requirements to strengthen compliance programs under AFA supervision. Executives and managers can be fined up to €200,000, face imprisonment for up to ten years, and potentially be banned from holding public office or serving as company directors.

Key Requirements of SAPIN II

Sapin II mandates the establishment of an internal anti-corruption program that includes the following elements:

Code of Conduct: A clearly defined code of conduct outlining acts that constitute corruption, integrated into the company’s internal regulations.

Internal Whistleblowing System: A confidential internal alert system that allows employees to report breaches of the code of conduct safely and anonymously.

Risk Mapping: Regularly updated risk maps to identify, analyze, and prioritize the company’s exposure to corruption risks, considering factors such as business sector and geographic location.

Third-Party Evaluation Procedures: Due diligence procedures for assessing the integrity and compliance of third parties such as suppliers, subcontractors, and business partners.

Accounting Controls: Robust internal or external accounting controls to ensure accurate and transparent financial records that prevent the concealment of corrupt activities.

Training Programs: Comprehensive training and awareness programs for employees, particularly those most exposed to corruption risks, to educate them on anti-corruption policies and practices.

Disciplinary Measures: Clear disciplinary measures for employees who violate the company’s anti-corruption policies, ensuring accountability.

Monitoring and Evaluation: Ongoing monitoring and evaluation of the effectiveness of the anti-corruption measures and internal controls, with periodic reviews and updates to reflect current risks and regulatory requirements.

GAN Integrity for SAPIN II Compliance

GAN Integrity supports these principles through a comprehensive anti-bribery management program, enhancing every aspect of compliance.

ABAC Program Management

Ensure your organization upholds ethical integrity and ABAC compliance through comprehensive risk assessments, effective policy management, and continuous monitoring. Capabilities include:

- Third-party due diligence: Mitigate bribery and corruption risks with integrated questionnaires, sanctions checks, and risk intelligence data.

- Disclosure management: Consolidate and assess conflicts of interest (COI), gifts, travel, entertainment, and political and charitable contribution disclosures.

- Reporting and documentation: Maintain a complete audit trail and detailed reporting to easily demonstrate compliance to stakeholders and regulators.

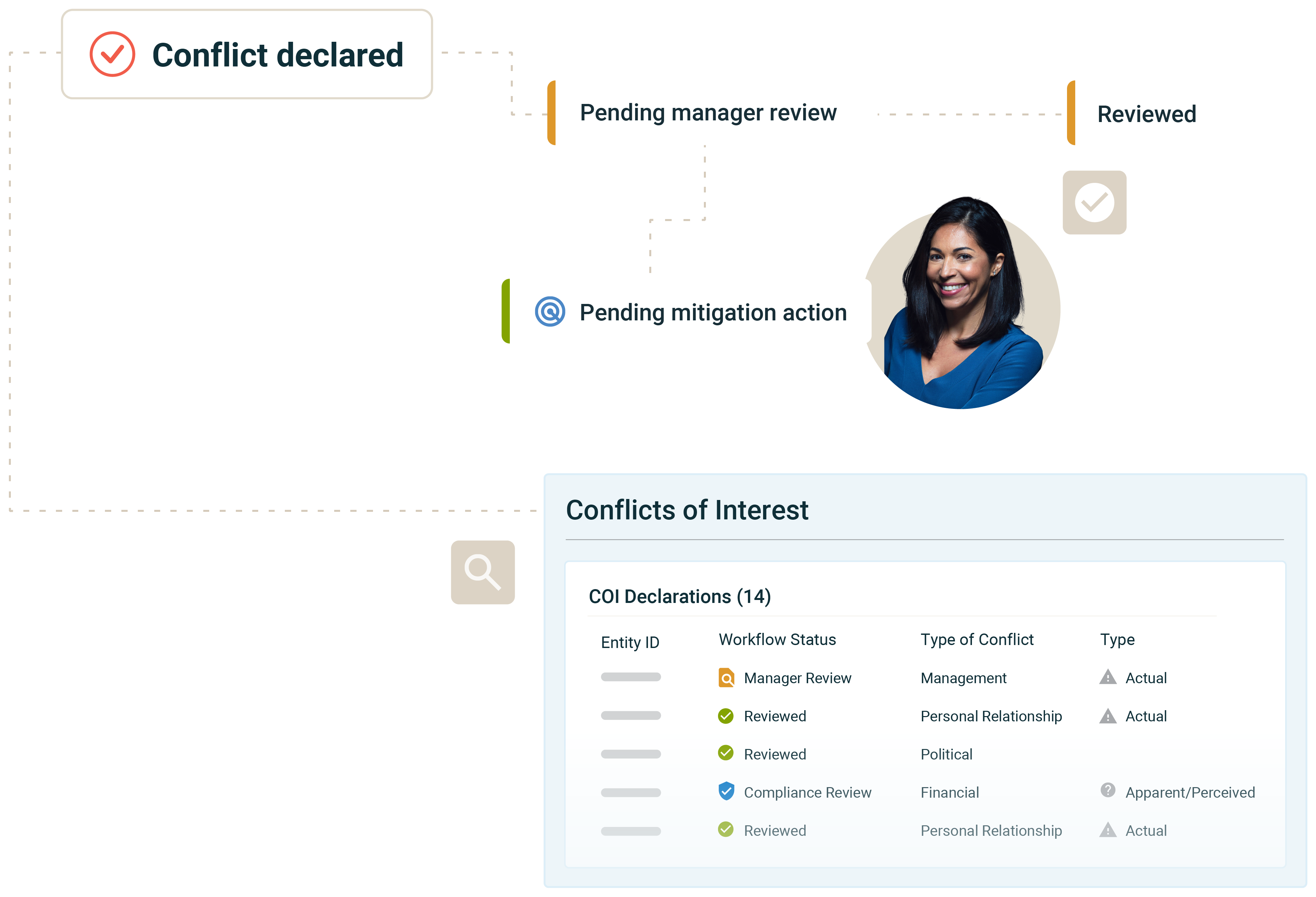

Conflict of Interests Management

Manage employee conflicts of interest disclosures with an easy to use, configurable platform. Capabilities include:

- Reporting and analytics: Role-based dashboards to identify areas of potential exposure with actions and remediation workflows to mitigate risks.

- Campaign Management: Create conflicts of interest campaigns to inform and engage employees with training, policies and regular disclosure campaigns.

- Third-party risk integration: Track conflicts of interest disclosures against third parties and suppliers for a comprehensive view of risk.

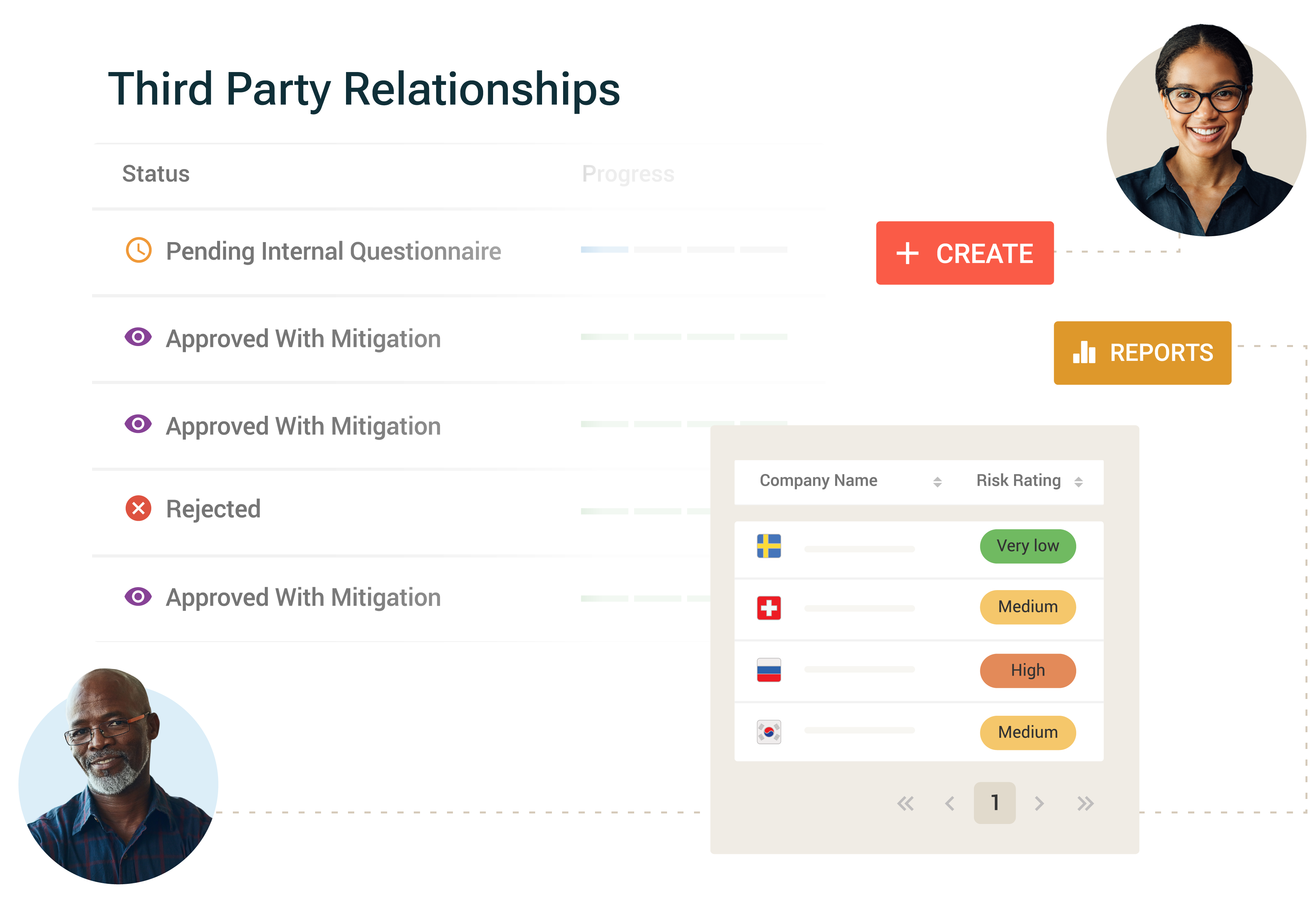

Third-Party Risk Management

Manage risks associated with third parties and assess these against relevant laws and organizational standards. Capabilities include:

- Lifecycle management: Automated workflows for onboarding, risk assessment, issue management, monitoring and off-boarding.

- Integrated due diligence: Initial and ongoing screening of third parties for sanctions, adverse media, forced labor, ESG and more.

- Reporting and analytics: Executive dashboards and reports: Consolidate third party data to identify risks and potential exposure to your organization

Disclosure Management

Consolidate your disclosures for conflicts of interest (COI), gifts, travel, entertainment, and political and charitable donations or contributions. Capabilities include:

- Policy management: Develop and enforce comprehensive disclosure policies. Educate and engage your workforce with targeted training and policy attestations.

- Flexible disclosure process: Simplify the submission of potential conflicts of interest with user-friendly forms, ensuring easy access for employees.

- Automated approvals and reviews: Enhance compliance with automated approval and review workflows. Quickly escalate notifications to relevant stakeholders to address potential risks.

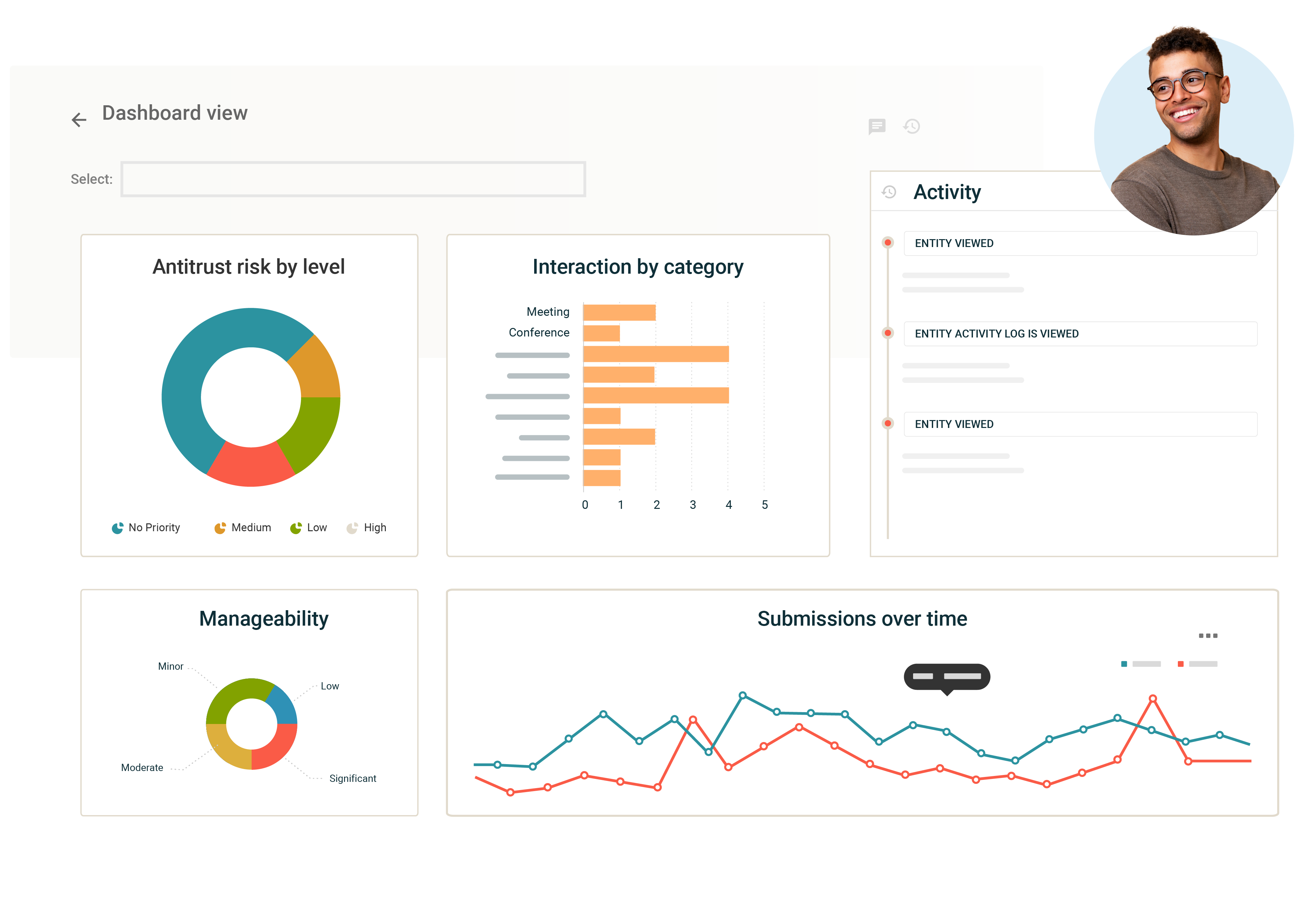

Reporting and Documentation

See everything across your compliance program, and generate reports and dashboards to demonstrate compliance program effectiveness to stakeholders and evidence to regulators. Capabilities include:

- Reporting and analytics: Executive, role-based dashboards to review the effectiveness of your compliance program initiatives.

- Evidence-based compliance: Maintain an auditable trail of all activity with the platform’s integrated and automated audit log.

- Compliance insights: See risk trends and patterns within your program, including third-party and supply chain risk, policies and disclosures.

Recent Resources

Frequently Asked Questions