Regulations

Compliance Solutions for the CSDDD

Benefit from a centralized, risk-based approach to compliance with the EU Corporate Sustainability Due Diligence Directive. Stay on top of your business operations, third parties and extended supply chains, operating with the confidence that you have robust and effective procedures in place.

Why GAN Integrity

GAN Integrity is how compliance teams get the tools and expertise to stay ahead of ESG risk. With less effort but more reach, you finally get a better way to do your good work.

See everything – Gain a comprehensive view of the upstream and downstream ESG risks associated with your extended supply chain.

Adapt to anything – Utilize a dynamic solution that adapts to regulatory changes and evolves with your program.

Get all the help you need – Receive dedicated support from GAN Integrity’s team of experts.

Understanding the EU Corporate Sustainability Due Diligence Directive

The European Commission's Corporate Sustainability Due Diligence Directive (CSDDD) is a transformative piece of legislation, Adopted by the EU Parliament in Spring 2024, aimed at fostering transparency and accountability in corporate practices concerning environmental, social, and governance (ESG) issues. The directive mandates that companies integrate sustainability into their core strategies and operations, thus ensuring long-term resilience and societal impact. The directive introduces stringent disclosure obligations, requiring companies to provide detailed reports on their environmental performance, social impact, and governance structures.

For sustainability and compliance officers, the directive signifies a shift towards proactive management of ESG issues rather than reactive reporting. Companies are expected to assess risks across their entire value chain and implement procedures to address identified risks.

Timelines for Compliance With The CSDDD

Adopted by the EU Parliament in Spring 2024, the CSDDD provides a two-year period for EU member states to transpose it into national law. Companies falling under different thresholds will have varying timelines to comply.

2027

Three years after the enforcement of the directive Group I will be expected to be compliant with its requirements

2028

Companies in Group II are granted an additional year before they are held accountable to the directive’s requirements.

2029

Companies in Group III will be granted a five-year timeline within which they will need to become compliant with the Directive.

Key Requirements of The EU Corporate Sustainability Due Diligence Directive

Under the EU Corporate Sustainability Due Diligence Directive (CSDDD), in-scope companies will be expected to take several significant actions to ensure compliance. These include:

Conduct Due Diligence: Companies must identify, prevent, mitigate, and account for adverse human rights and environmental impacts in their operations, subsidiaries, and value chains.

Adopt a Due Diligence Policy: This policy must outline the company's approach to due diligence and be updated annually. It should include a code of conduct for employees and subsidiaries, as well as processes for implementing due diligence.

Assess Actual and Potential Adverse Impacts: Regularly monitor and assess actual and potential adverse human rights and environmental impacts associated with the company's activities and those of its business relationships.

Take Action to Prevent or Mitigate Impacts: Implement appropriate measures to prevent or mitigate identified adverse impacts. This could include changing business practices, working with business partners to address issues, and investing in solutions to reduce harm.

Establish a Complaints Mechanism: Set up a mechanism that allows affected individuals and communities to raise concerns about adverse impacts. This mechanism should be accessible and transparent.

Monitor the Effectiveness of Policies and Measures: Continuously monitor the effectiveness of the due diligence policies and measures, making adjustments as necessary to ensure they remain effective.

Report on Due Diligence: Provide public reports on due diligence efforts, including the identified impacts, actions taken, and the effectiveness of those actions. These reports should be accessible and understandable to stakeholders.

Integrate Due Diligence into Corporate Governance: Ensure that due diligence processes are integrated into corporate governance and decision-making processes, with oversight from the company’s board of directors.

GAN Integrity for the EU Corporate Sustainability Due Diligence Directive

GAN Integrity’s platform is designed to support companies in maintaining robust ESG compliance programs that meet CSDDD requirements.

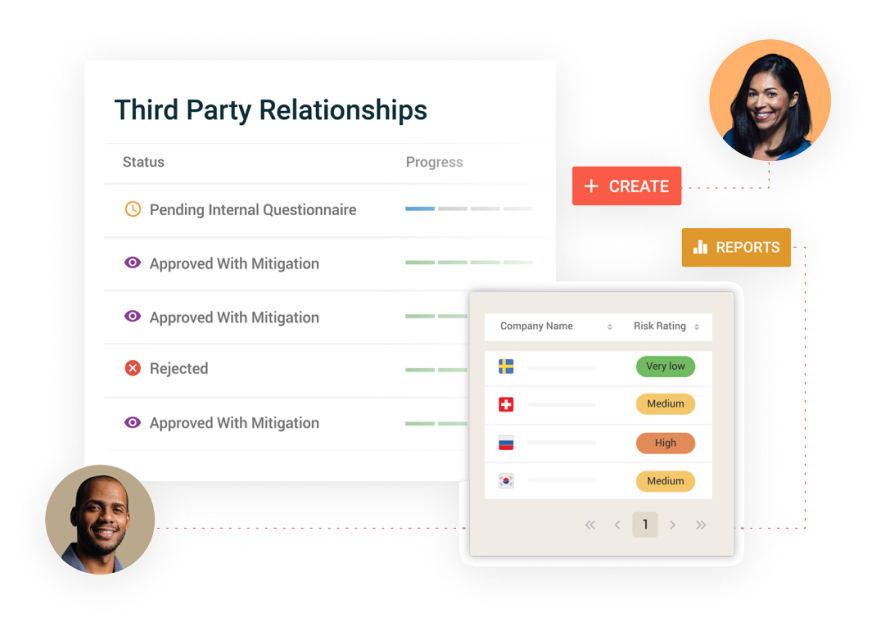

Third-Party Risk Management

Manage risks associated with third parties and assess these against relevant laws and organizational standards. Capabilities include:

- Lifecycle management: Automated workflows for onboarding, risk assessment, issue management, monitoring and off-boarding.

- Integrated due diligence: Initial and ongoing screening of third parties for sanctions, adverse media, forced labor, ESG and more.

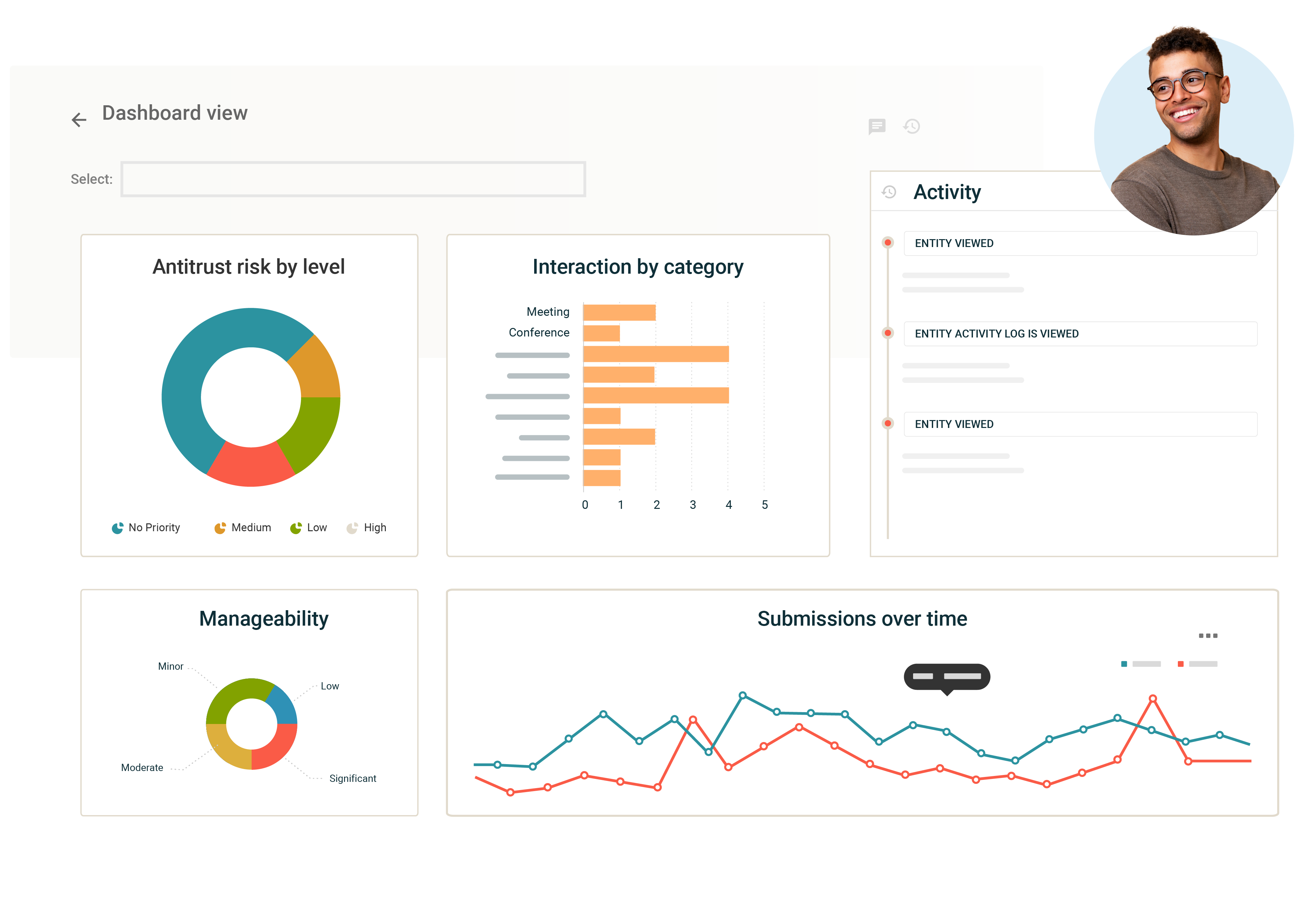

- Reporting and analytics: Executive dashboards and reports: Consolidate third party data to identify risks and potential exposure to your organization.

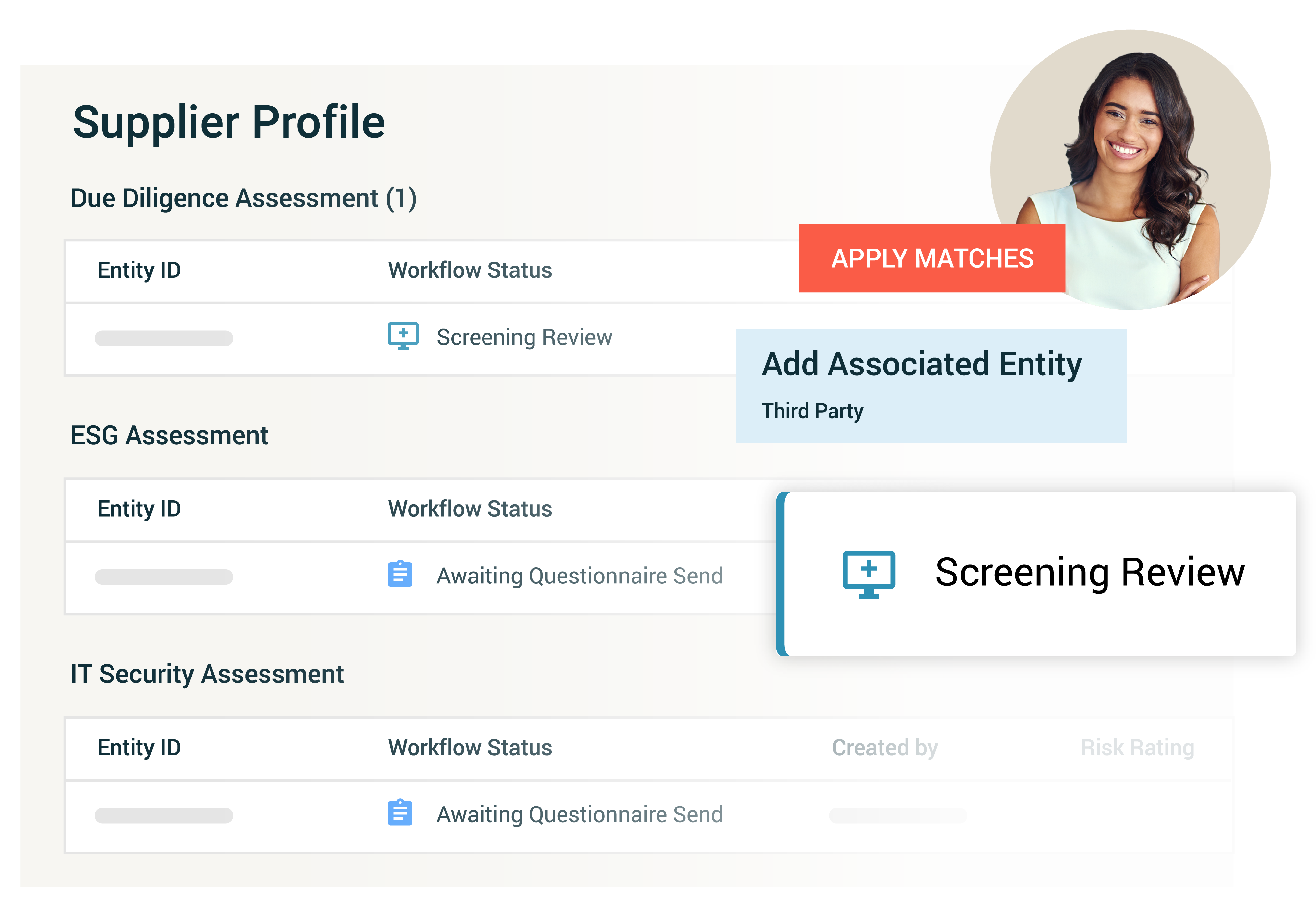

Supply Chain Due Diligence

Enhance supply chain risk management by consolidating processes, identifying and mitigating risks, and integrating data from various risk intelligence and business systems. Capabilities include:

- Automated risk assessments and continuous monitoring: Monitor suppliers continuously for adverse media, sanctions lists, PEP lists, forced labor, and ESG (Environmental, Social, and Governance) issues.

- High-risk supplier identification and management: Identify high-risk suppliers, manage them effectively, and track actions and mitigations to ensure compliance.

- Integrated due diligence assessments: Perform thorough due diligence across your business operations and workflows for seamless integration and enhanced efficiency.

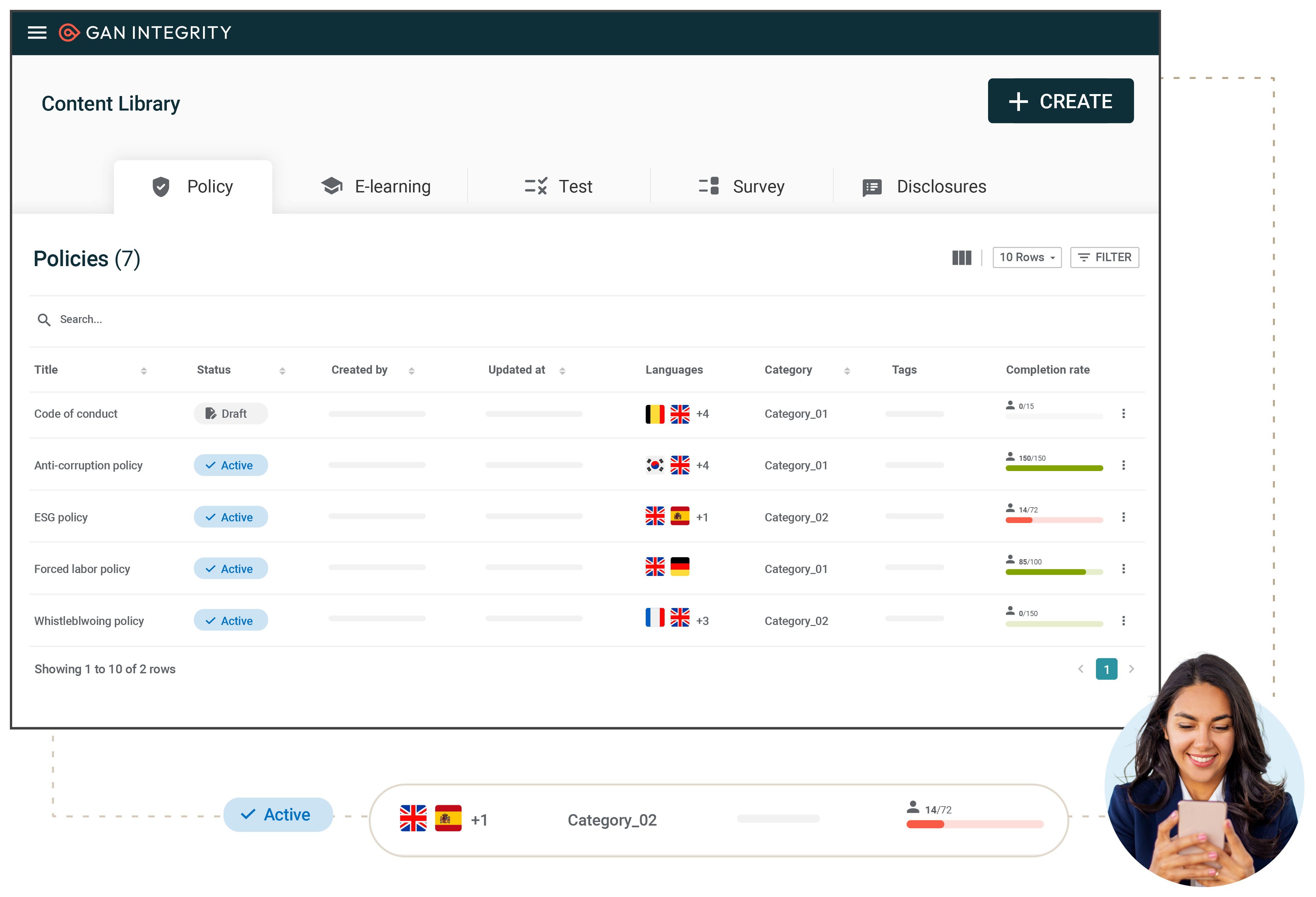

Policy Management

Manage approvals, distribution, and attestation of policies, along with centralized portals for easy access to the latest policies and procedures. Capabilities include:

- Regulatory change management: Identify policies that require updates and timely distribution to employees in response to regulatory changes.

- Automated workflow: Optimize the review and approval process for policies, operating procedures, and work instructions with automated workflows.

- Comprehensive reporting and documentation: Maintain a full audit trail and generate detailed reports to provide clear evidence of compliance to stakeholders and regulators.

Disclosure Management

Consolidate your disclosures for conflicts of interest, gifts, travel, entertainment, and political and charitable donations or contributions. Capabilities include:

- Policy management: Develop and enforce comprehensive disclosure policies. Educate and engage your workforce with targeted training and policy attestations.

- Flexible disclosure process: Simplify the submission of potential conflicts of interest with user-friendly forms, ensuring easy access for employees.

- Automated approvals and reviews: Enhance compliance with automated approval and review workflows. Quickly escalate notifications to relevant stakeholders to address potential risks.

Reporting and Documentation

See everything across your compliance program, and generate reports and dashboards to demonstrate compliance program effectiveness to stakeholders and evidence to regulators. Capabilities include:

- Reporting and analytics: Executive, role-based dashboards to review the effectiveness of your compliance program initiatives.

- Evidence-based compliance: Maintain an auditable trail of all activity with the platform’s integrated and automated audit log.

- Compliance insights: See risk trends and patterns within your program, including third-party and supply chain risk, policies and disclosures.