Financial Services

Compliance Solutions for the Financial Services Industry

Benefit from a centralized and data-driven approach to corporate compliance, ethics and third-party risk management that's trusted by major financial services firms worldwide.

Trusted by the world’s leading firms

Why leading financial services firms rely on GAN Integrity

GAN Integrity is how compliance teams at financial services firms get the tools and expertise to stay ahead of risk. With less effort and more reach, you finally get a better way to do your good work.

See everything – Gain a complete picture of overall regulatory risk and compliance in one place.

Adapt to anything – Tailor the platform to your organization, regardless of your tech stack, regions, risk appetite, and other complexities -all without heavy lifting or expense.

Get all the help you need – Receive dedicated support from GAN Integrity’s expert team.

Compliance challenges for the financial services industry

Compliance teams in the financial services industry can feel like they face an unfair fight. The sector is under intense regulatory scrutiny with new capital requirements, consumer compliance mandates, and enhanced governance expectations.

Teams must manage a wide range of programs, including Anti-Bribery and Anti-Corruption (ABAC), Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF), cybersecurity and operational resilience, data privacy and protection, and consumer protection and fair treatment.

Third-party risk management and operational resilience are also key concerns, particularly with dependencies on critical third parties. Managing the compliance risks associated with the use of AI and other emerging technologies adds another layer of complexity.

Key areas of compliance for financial services

Financial services firms are complex enterprises. There are many areas of compliance, ethics, and risk that need to be managed, spanning everything from Anti-Bribery And Corruption (ABAC), to Environmental, Social and Governance (ESG), to Ethical Conduct and Training. These include:

- ABAC Compliance: Upholding anti-bribery and anti-corruption (ABAC) laws such as the Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act.

- Third-Party Risk Management: Ensuring that third parties, suppliers, and partners comply with relevant laws and standards.

- Data Protection: Safeguarding sensitive information and ensuring compliance with data privacy regulations including GDPR and the California Consumer Privacy Act (CCPA).

- Financial Reporting: Maintaining accuracy and transparency in financial dealings in compliance with regulations such as the Sarbanes-Oxley Act (SOX).

- Conflict of Interest Management: Ensuring potential conflicts are disclosed and managed to uphold ethical standards.

- Regulatory Reporting: Complying with reporting requirements from regulatory bodies such as the SEC and FINRA.

- Ethical Conduct and Training: Promoting a culture of ethics through comprehensive training programs and codes of conduct.

- AML Compliance: Ensuring adherence to anti-money laundering regulations like the Bank Secrecy Act (BSA) and the EU’s AML directives.

- Continuous Improvement: Regularly updating and enhancing compliance measures.

Steps to achieving compliance in the financial services industry

Achieving compliance in any organization involves a series of strategic steps:

Compliance in the Financial Industry

Risk Assessment

Identify potential compliance risks specific to your financial services operations.

Objective Setting

Define clear compliance goals that align with your operational objectives.

Documentation

Maintain thorough records of compliance efforts and decisions.

Training

Educate employees about compliance requirements tailored to the financial services industry.

Monitoring and Auditing

Regularly review compliance status and adjust practices as needed.

Reporting System

Establish clear channels for reporting issues and disclosures.

Issue Response

Quickly address non-compliance issues to prevent disruptions.

Continuous Improvement

Regularly update compliance practices to stay ahead of regulatory changes.

GAN Integrity for Financial Services

GAN Integrity’s ethics compliance and risk management platform streamlines the compliance process by organizing requirements, automating tasks, and providing up-to-date information on regulatory changes, making it easier for you to do your work. Compliance teams can see everything, adapt to anything, and get all the help they need.

Disclosure Management

Consolidate your disclosures for conflicts of interest, gifts, travel, entertainment, and political and charitable donations or contributions. Capabilities include:

- Policy management: Develop and enforce comprehensive disclosure policies. Educate and engage your workforce with targeted training and policy attestations.

- Flexible disclosure process: Simplify the submission of potential conflicts of interest with user-friendly forms, ensuring easy access for employees.

- Automated approvals and reviews: Enhance compliance with automated approval and review workflows. Quickly escalate notifications to relevant stakeholders to address potential risks.

ABAC Program Management

Ensure your organization upholds ethical integrity and ABAC compliance through comprehensive risk assessments, effective policy management, and continuous monitoring. Capabilities include:

- Third-party due diligence: Mitigate bribery and corruption risks with integrated questionnaires, sanctions checks, and risk intelligence data.

- Disclosure management: Consolidate and assess conflicts of interest, gifts, travel, entertainment, and political and charitable contribution disclosures.

- Reporting and documentation: Maintain a complete audit trail and detailed reporting to easily demonstrate compliance to stakeholders and regulators.

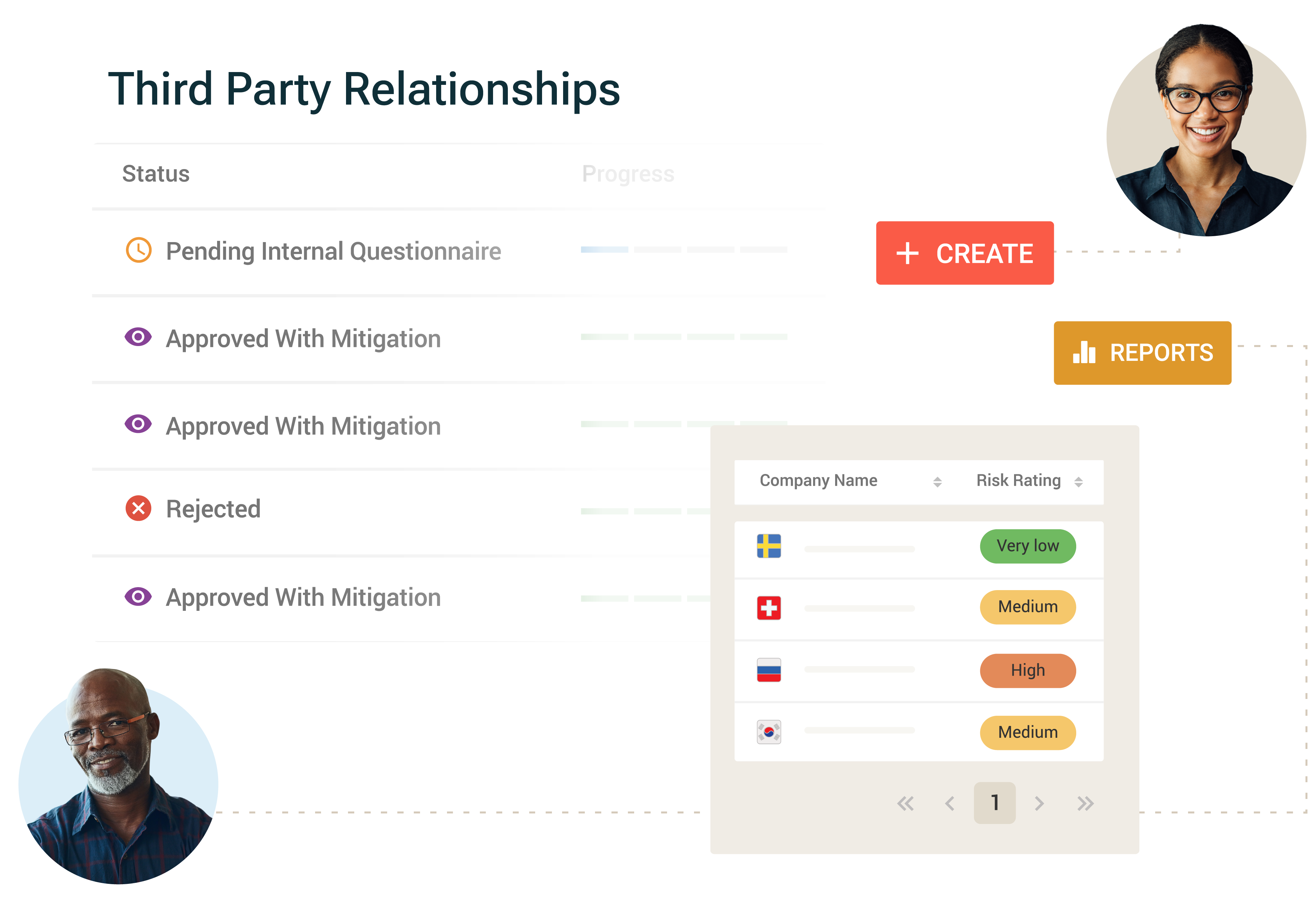

Third-Party Risk Management

Manage risks associated with third parties and assess these against relevant laws and organizational standards. Capabilities include:

- Lifecycle management: Automated workflows for onboarding, risk assessment, issue management, monitoring and off-boarding.

- Integrated due diligence: Initial and ongoing screening of third parties for sanctions, adverse media, forced labor, ESG and more.

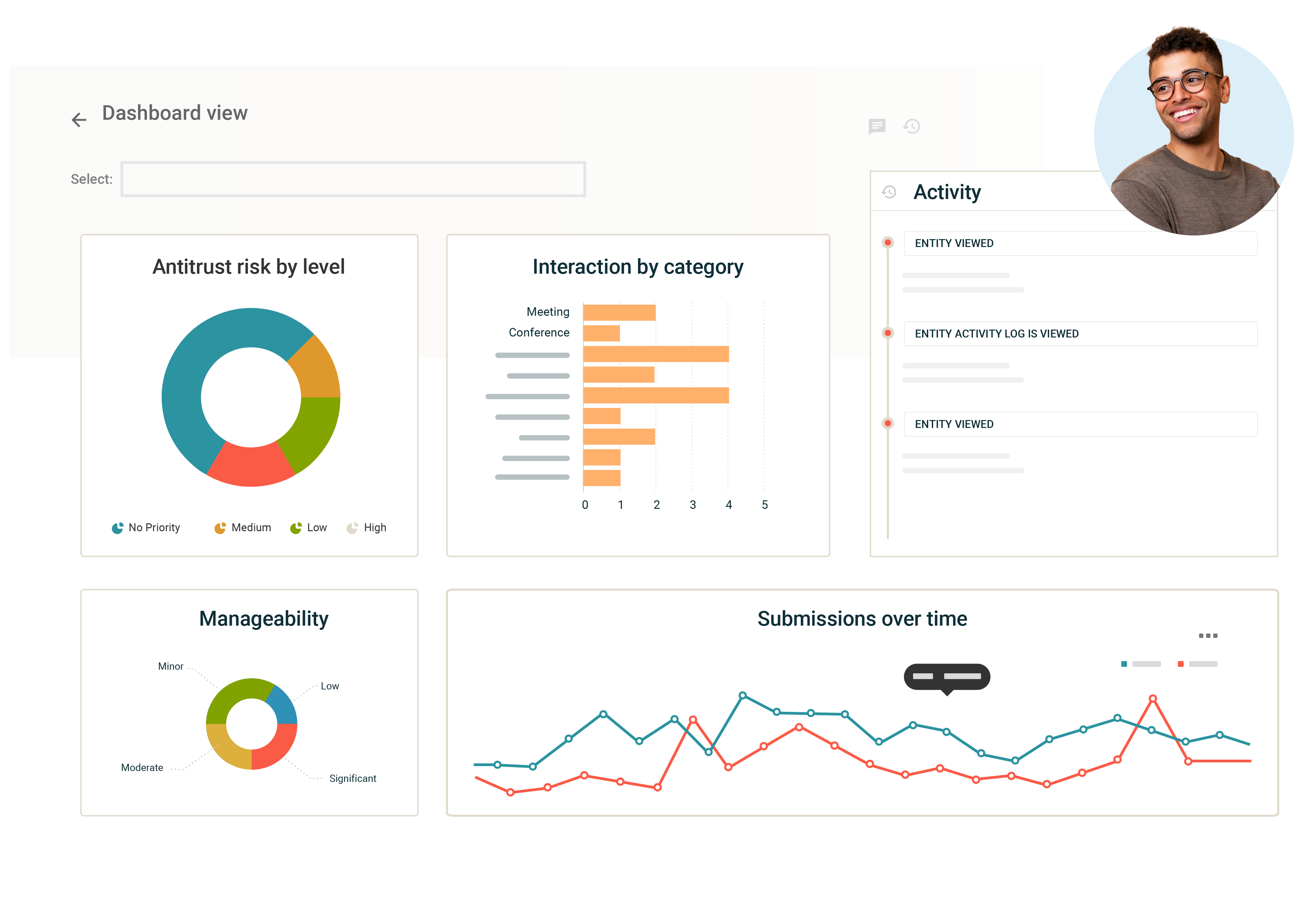

- Reporting and analytics: Executive dashboards and reports: Consolidate third party data to identify risks and potential exposure to your organization

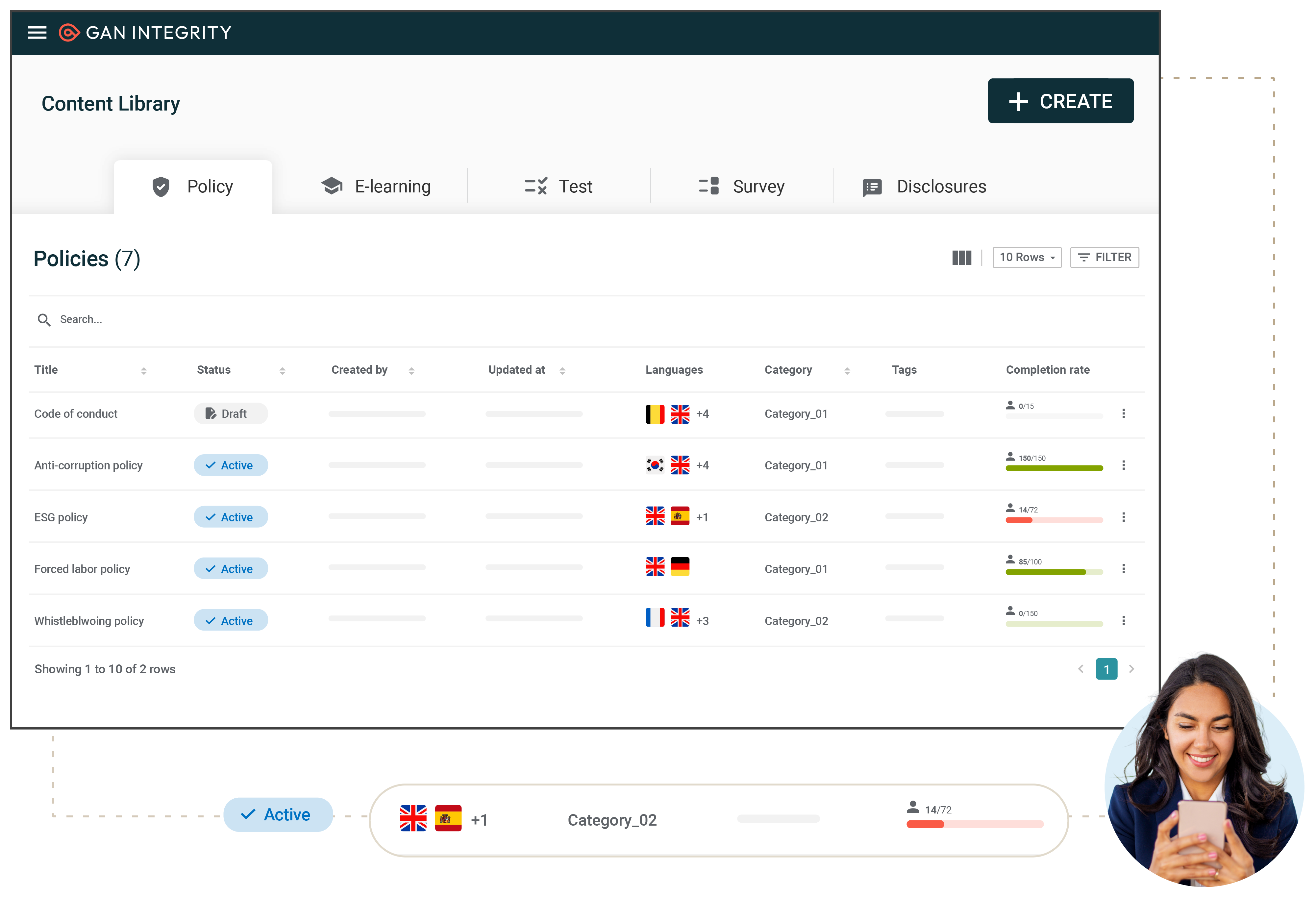

Policy Management

Manage approvals, distribution, and attestation of policies, along with centralized portals for easy access to the latest policies and procedures. Capabilities include:

- Regulatory change management: Identify policies that require updates and timely distribution to employees in response to regulatory changes.

- Automated workflow: Optimize the review and approval process for policies, operating procedures, and work instructions with automated workflows.

- Comprehensive reporting and documentation: Maintain a full audit trail and generate detailed reports to provide clear evidence of compliance to stakeholders and regulators.

Reporting and Documentation

See everything across your compliance program, and generate reports and dashboards to demonstrate compliance program effectiveness to stakeholders and evidence to regulators. Capabilities include:

- Reporting and analytics: Executive, role-based dashboards to review the effectiveness of your compliance program initiatives.

- Evidence-based compliance: Maintain an auditable trail of all activity with the platform’s integrated and automated audit log.

- Compliance insights: See risk trends and patterns within your program, including third-party and supply chain risk, policies and disclosures.