Blog

What’s Causing Compliance Teams Insomnia?

Thursday, July 3, 2025

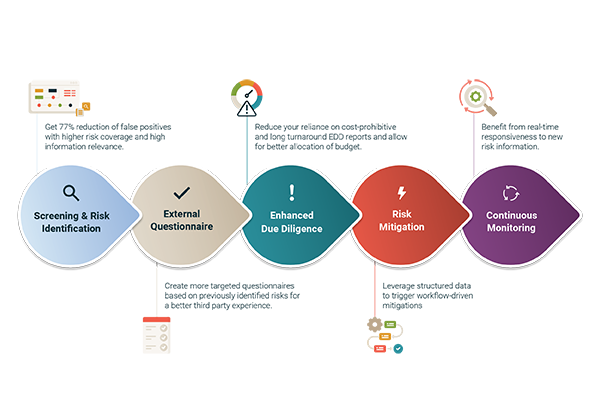

Discover the key issues that compliance teams are prioritizing and how GAN Integrity's platform can help navigate challenges and achieve peace of mind.

Learn More